Have you ever felt like your paycheck isn’t stretching as far as it should? Rising costs may be part of the reason, but many of us also unknowingly pay hidden fees and extra charges that add up over time. From sneaky subscription costs to unnoticed service fees, these expenses can drain your finances. Here’s how to uncover the hidden costs in your life and start cutting them today.

1. Subscription Traps

With streaming, fitness apps, and various monthly services, subscriptions are now a standard part of everyday life. While signing up for a service might initially seem inexpensive, those $10 or $20 monthly fees can add up quickly if you’re not using them. Many overlook free trials that convert into paid subscriptions after the trial period ends. According to surveys, Americans spend around $200 monthly on subscriptions, with a good chunk going to unused services.

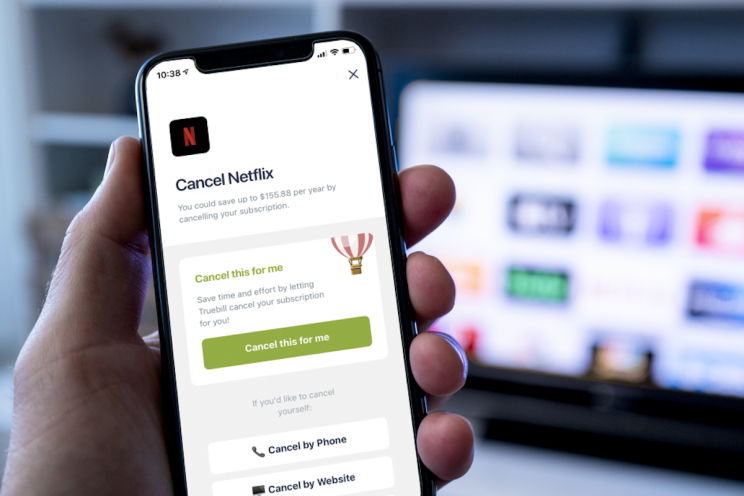

Solution: Review your bank or credit card statement for recurring charges. Cancel any subscriptions you’re not actively using. Some apps, like Truebill, can even help you track and cancel unwanted subscriptions for a small fee.

2. Banking and Credit Card Fees

Banks and credit card companies charge a surprising variety of fees—monthly maintenance fees, overdraft charges, ATM fees, and even foreign transaction fees. Some people lose hundreds of dollars annually due to these hidden costs, mainly if they frequently use out-of-network ATMs or carry credit card balances that incur interest.

Solution: Consider switching to a bank with no or minimal fees, like an online bank that refunds ATM charges. Review your credit card terms and look for cards with no foreign or annual transaction fees. Additionally, keep an eye on your balance to avoid overdraft charges, which can be steep.

3. Unnecessary Warranties and Insurance

Extended warranties on electronics and appliances often seem like a wise investment but are not worth the extra cost. Most items come with manufacturer warranties, and repair costs are frequently less than the warranty price. Similarly, credit cards and rental car companies usually offer protection for purchases or car rentals, meaning you might already have coverage that makes extra insurance unnecessary.

Solution: Check if your credit card offers protection before purchasing a warranty. Avoid paying for rental car insurance if your credit card or personal car insurance already covers it.

4. Unused or Excessive Data Plans

Many people pay for mobile phone plans with more data than they need, or they go over their data limit and incur extra fees. Likewise, home internet providers often bundle services or upsell customers to higher tiers than necessary. Paying for unused data or additional services is a standard hidden cost that can add up yearly.

Solution: Review your data usage over the past few months and consider downgrading your plan if you don’t use all of it. For home internet, contact your provider and ask about lower-tier plans that could fit your needs at a lower cost.

5. Energy Vampires in Your Home

Even when turned off, appliances and electronics that remain plugged in still draw a small amount of power, known as “phantom energy.” This can increase your energy bill over time without you realizing it. According to the U.S. Department of Energy, standby power can add up to 10% of your annual electricity bill.

Solution: Unplug appliances when not in use or invest in smart power strips that cut off energy flow when devices are off. Simple actions, like turning off lights in empty rooms or adjusting your thermostat, can also reduce your monthly bill.

Final Thoughts

Hidden costs are everywhere, from small subscriptions to unnoticed utility fees. By staying vigilant and regularly reviewing your spending habits, you can identify areas to cut costs and keep more of your money where it belongs: in your pocket. Reducing these expenses doesn’t require drastic lifestyle changes—just a little mindfulness and effort. So, start auditing your budget, cut unnecessary costs, and enjoy the benefits of a leaner, more efficient spending plan.